Studies show that as January goes, the rest of the year follows. As Ryan Detrick, Chief Market Strategist for LPL Financial recently noted, a weak February typically follows a poor January. Not to mention, the rest of the year usually won't do much either.

If you are nervous about your IRA, it’s understandable.

Summary Table: Top 5 Silver IRA companies

| Top Overall Silver IRA Company: | Regal Assets: regalassets.com |

|---|---|

| Best for Rollovers: | Regal Assets: regalassets.com |

| Best Flat Fees: | Regal Assets: regalassets.com |

| Best for Crypto: | Regal Assets: regalassets.com |

| Best for Coins/Bullion: | JM Bullion: jmbullion.com |

| Best for Market News: | Kitco: kitco.com |

| Most User-Friendly: | apmex.com, regalassets.com, goldsilver.com |

‘Summary table by Jules Blundell'

Long-term protection against macro risks is paramount. Physical silver is an excellent example of a safe-haven investment with several properties that can help protect your nest egg for the long-term such as:

Inflation Protection

Inflation is at a 40-year high, has proven not to be “transitory,” and could persist well into 2022. As cash continues to depreciate, silver, like other precious metals, has intrinsic value and can protect both your IRA and purchasing power.

Yet, silver may be an even better inflation hedge than gold. According to Morgan Stanley, “Historically, both gold and silver have made solid gains when US inflation is rising. Both metals are valued in US dollars, so when the dollar falls in value, gold and silver typically rise because they become less expensive to buy using other currencies. Given greater industrial demand, silver tends to rise more than gold with rising inflation and a falling dollar.”

Widespread Demand and Usage

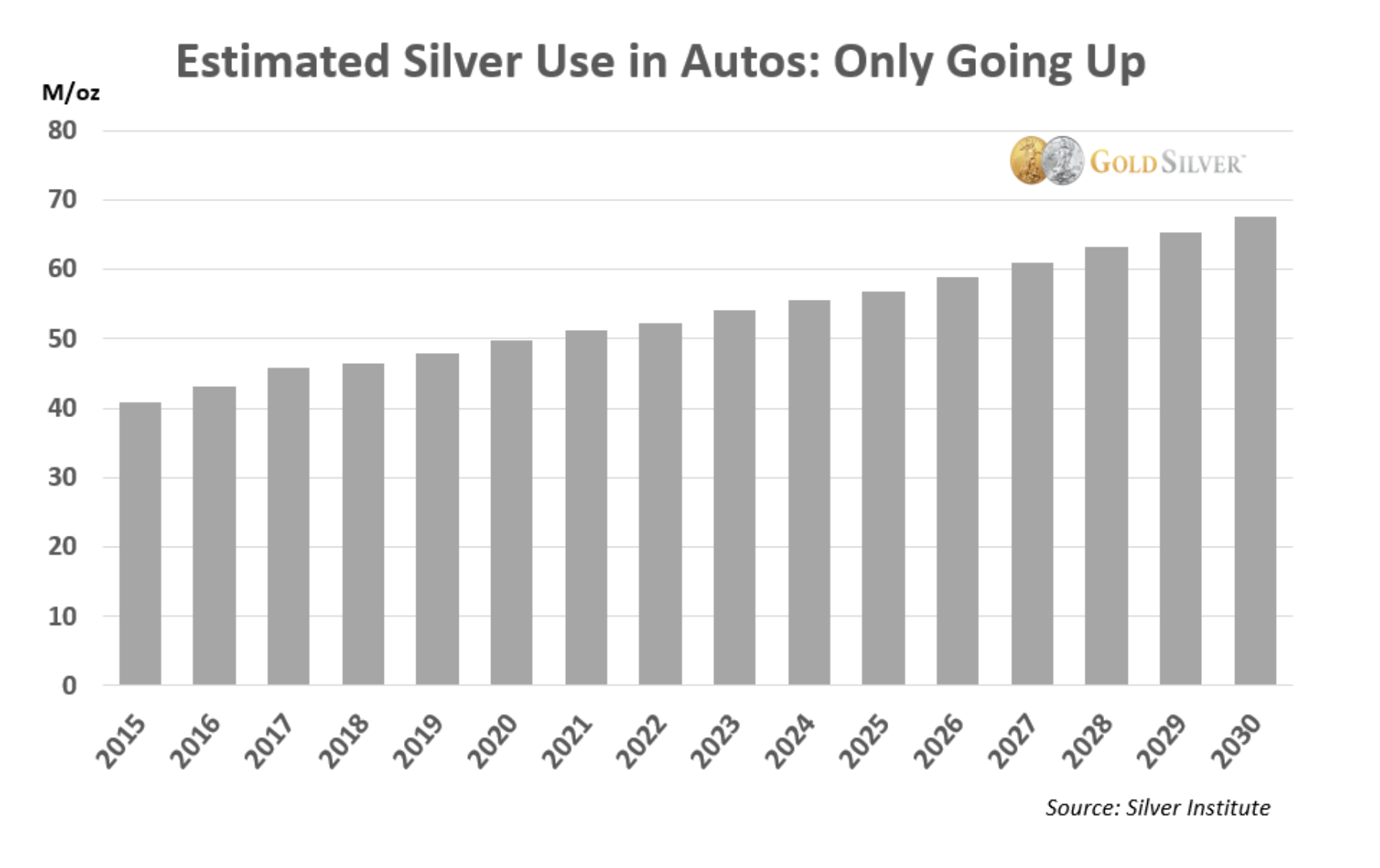

Russ Koesterich of BlackRock went further in the silver vs. gold debate. He noted that silver has more industrial uses than gold, namely with electronic devices, electrical systems, and solar panels.

An EV space that could become a $46 trillion industry by 2050 also uses a great deal of silver. EVs rely on silver for "the electric engine, battery pack, and battery management system."

‘Screenshot from goldsilver.com’

Demand is only continuing to rise, too. Outside the evolution of technology and industry, silver serves critical purposes for banks, financial institutions, and governments.

Long-Term Growth at a Discount

Kelli Click, president of the STRATA Trust Company, notes that people have an interest in precious metal IRAs because precious metals add long-term security, “including reducing your potential investment volatility and risk, serving as a hedge in the event of an economic downtown and providing a tax-efficient shelter for potential gains.”

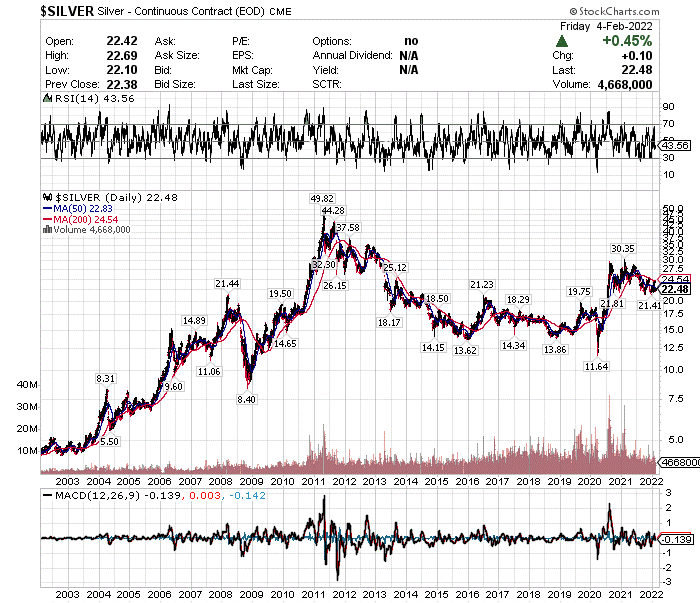

Silver is unique because of its limited supply and surging demand. It is also an asset whose value today is much higher than 100 years ago, let alone since roughly the year 2000. Its discounted price coupled with soaring demand could make for a mouth-watering entry point.

‘Screenshot from stockcharts.com'

Plus, according to Morgan Stanley, “Silver is much cheaper than gold, making it more accessible to small retail investors. For those who are just starting to build their portfolios, the cost of silver may make it a better investment choice.”

Diversity

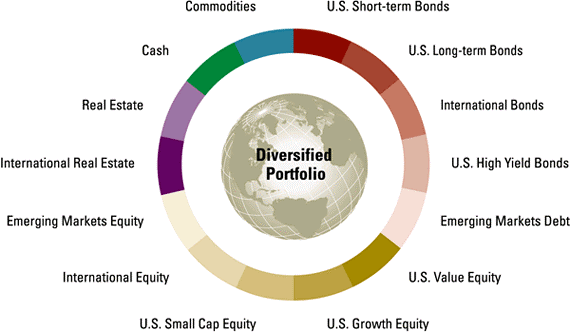

Diversification is critical in turbulent times. When one investment underperforms, another one can outperform. Look at January’s S&P; performance, for example. Pandemic winning stocks like Netflix and Moderna tanked while energy stocks surged. The opposite happened throughout 2020.

‘Screenshot from goldiraguide.org’

According to Business Insider, “Since it's impacted by different influences, silver can be a good way to diversify and counterbalance your portfolio vis-a-vis equities or other paper securities.”

Liquidity

Silver is highly revered and popular to add to IRAs because of its liquidity, ubiquity, and versatility in trading.

People are understandably worried about inflation and imminent interest rate hikes. Consequently, many investors are looking for alternatives to stock-heavy retirement accounts. Gold IRAs are reasonably well-known, but Silver IRAs could be an equally opportune place to turn to with potentially more upside. You might be asking yourself how you can start ASAP.

Here are five things you should know first.

1. Do Your Homework On Dealers

Make sure you do your due diligence. Silver, in theory, has a great blend of protection, stability, and growth potential. But understand what specific silver assets your IRA will be investing in and the rules.

The IRS does not play around and has some strict conditions.

- US-accredited manufacturers must produce bars to given standards (ISO 9000, TOCOM, LPPM, LBMA, LME, NYSE, COMEX, NYMEX) or sovereign mints.

- Small bullion bars must be produced to specific weights — apart from bars of 400-ounce gold, 1000-ounce silver, 50-ounce platinum, and 100-ounce palladium.

- Bullion in bars must be of ‘ … a fineness equal to or exceeding the minimum fineness that a contract market (as described in section 5 of the Commodity Exchange Act, 7 U.S.C. 7) requires for metals which may be delivered in satisfaction of a regulated futures contract.’ (Section 408/M of the IRS code) Compared to gold, platinum, and palladium, silver must be the purest of them all.

| Precious metal | Minimum purity allowed by the IRS |

|---|---|

| Gold | 99.5% |

| Silver | 99.5% |

| Platinum | 99.95% |

| Palladium | 99.95% |

Do your homework on dealers, too. Dealers set the price for silver, and you want a good one that will get you a fair price. Make sure you see what other investors are saying or reviewing about a dealer, too.

Of course, many bad actors exist out there, and it would be a catastrophe if you entrusted retirement savings with a scammer.

“Before choosing a dealer and buying precious metals with your IRA funds, you’ll want to do your own research,” says Kelli Click, president of the STRATA Trust Company. “Look for a dealer that belongs to industry trade groups like American Numismatic Association (ANA), Industry Council for Tangible Assets (ICTA) or Professional Numismatists Guild (PNG) to help with your search.”

2. Learn About Depositories, Storage, and Pricing

Good luck successfully adding silver to your IRA without first understanding the importance of depositories, storage, and pricing.

- Depositories are essential when purchasing physical assets to hold in an IRA. They must fully comply with IRS regulations, or else, a non-bank trustee will hold your silver.

- It is essential to understand storage before adding silver to your IRA. You want your assets protected, and any sketchy storage facility poses this risk. Once stolen, silver is gone. It’s untraceable. So make sure that your storage facility is adequately insured.

- Depositories primarily consist of two types of storage facilities– commingled and segregated.

- Commingled storage is a vault holding metals owned by numerous owners.

- Segregated storage is a locker system used to segregate silver from other precious metals within the depository. The coins or bullions placed in segregated storage are also the exact ones removed from the depository.

- Pricing on a storage facility can vary from hundreds to thousands of dollars and be assessed quarterly or annually. Fees may also be fixed or adjusted based on the value of silver held.

3. Decide on Account Type

The only way to add silver to your retirement account is through a self-directed IRA monitored by an independent custodian. We will later go into more detail about custodians. Still, most traditional financial managers won’t even offer you the opportunity to open a self-directed IRA.

Self-directed IRAs have the same tax benefits and IRS guidelines as traditionally managed IRAs. The difference is you’re the one choosing what to invest in rather than what the broker presents.

Until the passing of The Taxpayer Relief Act of 1997, you could only invest in assets such as stocks, bonds, ETFs, and mutual funds in their IRA accounts. The Act stated: "Your IRA can invest in one, one-half, one-quarter, or one-tenth ounce U.S. gold coins, or one-ounce silver coins minted by the Treasury Department. Beginning in 1998, your IRA can invest in certain platinum coins and certain gold, silver, palladium, and platinum bullion."

1. Traditional IRA

- For individual taxpayers

- Tax-deductible contributions

- Money withdrawn is taxed at the ordinary income tax rate

- Annual individual contributions cannot exceed $6,000

- Contributions from those 50 or older can be up to $7,000 per year

2. Roth IRA

- For individual taxpayers

- Not tax-deductible

- Qualified distributions are tax-free

- Contributions with after-tax dollars are ok, and you do not have to pay any capital gains taxes

- Can withdraw after retirement without incurring income taxes

- No RMDs. If you don't need the money, you don't need to withdraw it

- As long as you have eligible income, you can contribute to a Roth IRA. There are no age restrictions.

3. SEP-IRA

- "Simplified employee pension"

- For self-employed people like independent contractors, freelancers, and small-business owners

- Same tax rules as traditional IRA

- SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less

4. Understand Fees and IRS Restrictions

Before setting up a Silver IRA, understand the fees and IRS restrictions.

The best things in life are not free, and Silver IRAs are no exception. Because Silver IRAs involve purchasing and storing precious physical assets, expect more fees than a standard retirement account.

Factor in the following:

- One-time mandatory setup fee

- Storage fees

- Transaction fees

- Premiums on coins (above spot)

- Annual custodian fees

- Cash-out fee if you liquidate

These fees are unavoidable because of the IRS. If you cut any corners, you risk crushing fees and penalties. Do not try storing your precious metals at home or skirting around the requirements of an approved Custodian and an approved Broker.

The IRS can be even stricter with contribution limits and withdrawals outside of these requirements and your silver's purity.

- Exceeding contribution limits

If you are aged under 59½, you can contribute $7,000 a year to your IRAs. If you are aged over 59½, the contribution limit is $6,500.

A penalty of 6% may apply for exceeding your contribution limits. - Early withdrawal of distributions

‘Distributions’ are what happens when you withdraw funds from your IRA. If you withdraw distributions before reaching the age of 59 ½, you will incur a 10% penalty plus income tax.

5. Select A Reputable Custodian

Selecting a reputable custodian with an accredited depository that can act as a broker is the holy grail for setting up Silver IRA. But they are few and far between.

Custodians include banks, credit unions, trust companies, loans and savings associations, and brokerage companies.

You will frankly not succeed without a good one.

First and foremost, the IRS requires it. Even though your Silver IRA account is self-managed, an IRS-approved custodian must oversee it.

An ideal custodian understands the intricacies of precious metals on top of traditional finance. They should help you create and administer a Silver IRA account and track all IRS dates, fees, and rules.

Ensure you also check custodian fees, the minimum investment they require, and whether they offer any promotions.

Who Are the Top 5 Silver IRA Companies?

There are many factors to consider when setting up a Silver IRA. You need a reputable dealer; you need an IRS-approved depository with secure storage; you must understand IRS regulations and potential fees.

These factors, of course, only scratch the surface.

It cannot be stressed enough that you want to do all you can to find a custodian who also acts as a broker with an IRS-approved depository. That way, you have it made with a one-stop shop that can streamline a complex process.

Correctly choosing what company you use to set up a Silver IRA is critical. It can be an arduous and complex process filled with scammers.

Be sure to ask the following 12 questions when looking for a company to help you.

- How long have you been in business?

- Do you sell bullion or collectibles?

- Are you a member of an official body?

- Do you get positive reviews from associations like BirdEye, Trustlink, and the Business Consumer Alliance?

- Do you keep a low profile, or are you known to respectable media?

- Do you sell IRS-approved bullion/coins, or do I have to find them myself?

- Is IRS-approved storage part of the deal?

- Do you have experience in IRA rollovers?

- Are there hidden fees, or is there a flat annual fee covering everything?

- Can I phone you and speak to an adviser whenever I want?

- Do you charge commissions when I sell my precious metals?

- Do you have a selection of silver/crypto portfolios that I can choose from to match my budget and risk appetite?

Consider this criterion as well:

- Transparency: Understand all your costs upfront to avoid hidden fees.

- Track record: Find a company with outstanding reviews from objective third parties. Look into what customers say or if there have been complaints filed.

- Flexibility: Find an adaptable and flexible company that will cater to your needs.

- Qualifications: Only go with a company with required licenses, registrations, insurance, and bonds to protect your investment. Double and triple-check this too.

Having said all that, we’ve put together a list of the top 5 companies that can help you start a Silver IRA.

The Top 5 Silver IRA Companies

#1 Regal Assets: The Most Well-Rounded, All-In-One Choice

Established: 2009

Website: regalassets.com

Phone Number: 1-877-205-1104

Locations: Los Angeles (LA), Waco (TX), Toronto (CA), and Dubai (UAE)

'Regal Assets Logo from regalassets.com'

Assets: Coins and Bars with IRA-Approved Silver, Gold, Platinum, and Palladium Bullion

Storage: Both segregated and non-segregated

Silver IRA Annual Fees: Flat $250 annual rate for segregated storage or $100 flat annual rate for non-segregated storage.

Thanks to companies like Regal Assets, forming a Silver IRA has never been easier. Regal is the top overall Silver IRA company because it acts as a one-stop-shop for all things related to setting up and monitoring a precious metal IRA.

No longer are you fed to the wolves and digging for an IRS-approved broker, custodian, and storage. Regal Assets covers it all under one roof and does the following:

- Set up and run your IRA

- Handle all IRS paperwork

- Provide a flat annual fee for all services

- Provide IRA-approved bullion and coins

- Act as IRS-approved custodian

- Store bullion and coins in IRS-approved vaults

- Handle IRA rollovers free-of-charge

‘Screenshot from regalassets.com'

Furthermore, Regal is:

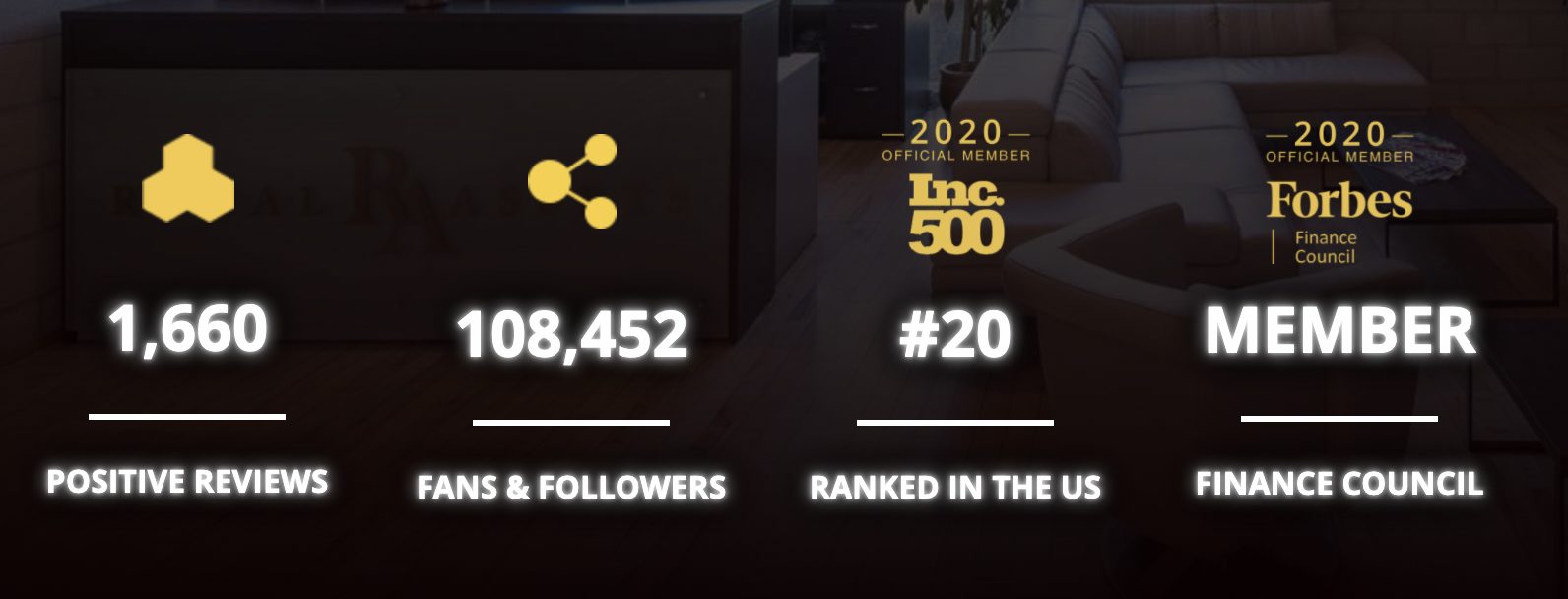

- An official member of the Forbes Finance Council

- A provider of hundreds of millions in retirement account transfers

- A company led by an experienced staff that will answer all questions and provide clarity without being pushy or aggressive

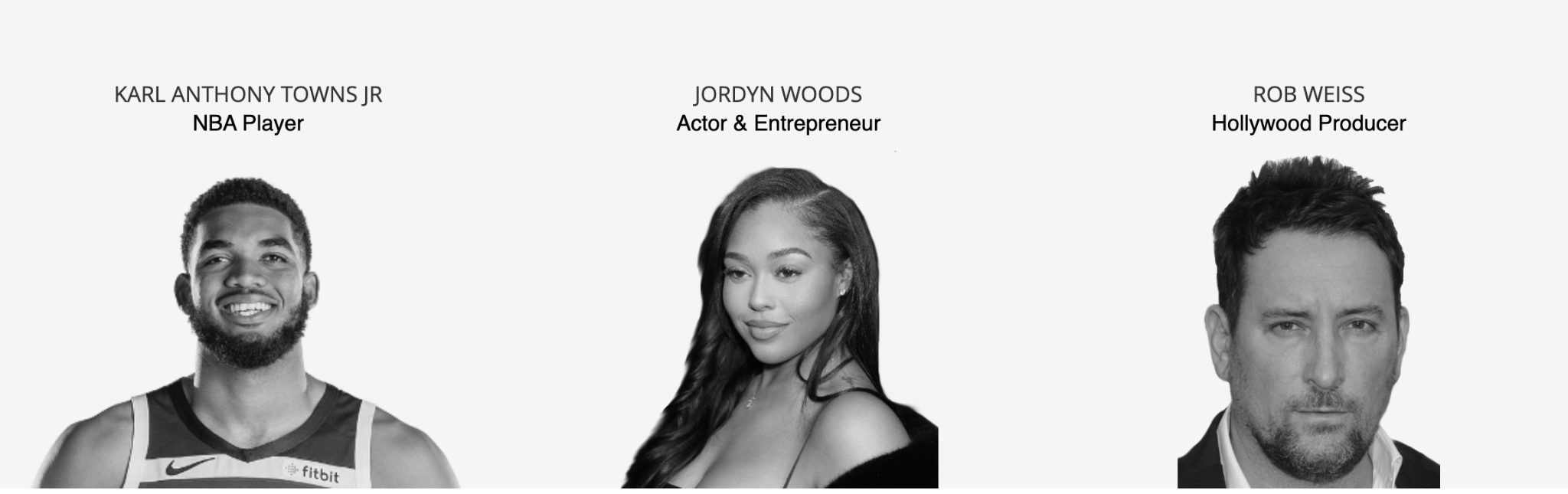

However, Regal’s sterling reputation among both investors and advisors is what truly sets them apart from the pack. Regal has been around for over a decade, garnered over 1,500 five-star reviews on BirdEye, and has had several well-known athletes and celebrities use their services.

‘Screenshot from regalassets.com'

‘Screenshot from regalassets.com'

With Regal Assets, the fear of juggling different companies to acquire your silver, set up the paperwork, and store bullion and coins is a thing of the past.

#2 JM Bullion: A Fantastic Choice for Diverse Precious Metals Investments

Established: 2000

Website: jmbullion.com

Phone Number: 1-800-276-6508

Locations: Oklahoma City, OK

‘JM Bullion Logo from jmbullion.com'

Assets: Gold, Silver, Platinum, Palladium, and Copper Bullion Coins and Bars. Also offers Collectibles.

Storage: Subject to Custodian

Silver IRA Annual Fees: Subject to Custodian

JM Bullion is one of the fastest-growing and profitable alternative investment companies on the market. Established in 2011, JM Bullion offers one of the most comprehensive ranges of IRS-approved precious metals, and has become extremely popular. With excellent customer service and a user-friendly website, JM has an overall satisfaction rating of 4.8/5 among over 300,000 customer reviews on its website.

Despite being a relatively small operation, JM Bullion ships over 60,000 bullion orders a month directly to customers with free shipping for orders over $199.

Of course, however, this is not a one-stop shop. It’s a specialist bullion retailer that works with an IRA custodian partner (New Direction) and IRS-approved storage partner (TDSVaults).

#3 GoldSilver: They Make It Easier Than Ever With Valuable Educational Material

Established: 2005

Website: goldsilver.com

Phone Number: 1-888-319-8166

Locations: Santa Monica, CA

‘GoldSilver Logo from goldsilver.com'

Assets: Both Gold and Silver Bullion available in Bars and Coins.

Storage: Subject to Custodian

Silver IRA Annual Fees: Subject to Custodian

Founded in 2005 by YouTube celebrity and best-selling author Mike Maloney, Goldsilver.com, as its name suggests, specializes in gold and silver investments. While it does not have the product range that other competitors offer, and does not offer collectibles or ‘numismatics’ (rare coins), it is a company very good at what it does.

Goldsilver.com President Alex Daley says, ‘we don't carry collectibles and other high- or subjective-mark-up products that you find at far too many gold retailers. Instead, we focus on the highly-recognized, low premium, widely-traded bullion coins, and bars.’

Goldsilver.com is an extremely useful platform for IRA investors. It is an easy-to-use website packed full of valuable information and educational resources. If you’re looking to learn more about precious metals, at the very least, you can’t go wrong with this platform. After all, Mike Maloney did write the best-selling “Guide to Investing in Gold and Silver.”

Goldsilver.com partners with several IRA custodians. It also promises its customers a streamlined process for purchasing and storing precious metals.

#4 Kitco: Long-Time Stalwart and the Best for Market News and Data

Established: 1977

Website: kitco.com

Phone Number: 1-877-775-4826

Locations: Montreal, Canada

‘Kitco Logo from online.kitco.com'

Assets: Gold, Silver, Platinum, And Palladium Bullion (Available in Coins, and Bars)

Storage: Both segregated and allocated

Silver IRA Annual Fees: Varies

Founded by Bart Kitner in 1977, Kitco is by far the oldest and most well-established company on this list. You don’t last this long and get this far in the precious metals space without great management and fantastic customer service.

While Kitco has spent more than 45 years successfully trading bullion, the real bread and butter of its reputation is its newsroom. With a sophisticated but user-friendly website, Kitco is by far the best source of gold and commodities market news, offering real-time price updates, live feeds from top news outlets, interactive charts, and in-depth articles.

Kitco CFO Nizar Tabet says, ‘we want to provide the best price and are very transparent in our pricing. We want to show customers exactly what they are paying for, so on our website, we provide information services and live market prices.’

Beyond buying and selling bullion, Kitco also offers technology and equipment for refining precious metals.

Kitco, though, has much more of a Canada focus than the other options on this list. Yet, it does offer IRA custodianship through various partners, and IRS-approved storage can then be made via one of these custodians.

#5 APMEX: Massive Bullion Selection

Established: 2000

Website: apmex.com

Phone Number: 1-800-514-4958

Locations: Oklahoma City, OK

‘Apmex Logo from apmex.com'

Assets: Gold, Silver, Platinum, Palladium, and Copper Metals. Numismatic (Collectibles), And Bullion Available (Coins, And Bars)

Storage: Subject to Custodian

Silver IRA Annual Fees: Subject to Custodian

APMEX, or the American Precious Metals Exchange, has been around since 2000, and consistently comes up as one of the best established and most popular options for precious metals investors.

The firm has a colossal selection of both IRS and non-IRS bullion ( bars and coins), and an extremely easy-to-use website. IRA-approved bars and coins have their own section on the website, but it’s very easy to get lost in their collection of non-IRA-approved rare coins.

APMEX can provide IRA custodianship via various partners. It is also very popular because of its partnership with Citadel Global Depository Services, which they use to vault customers’ metals.

Wrapping Up

Silver has been a valuable, tangible asset for thousands of years. Never, as much as today, have silver's unique properties made it more attractive to add to an IRA.

- It can protect your nest egg from economic turmoil and inflation.

- It has widespread industrial and technological uses and could see soaring demand.

- It has offered long-term growth historically and is currently trading at a discount.

- It can diversify your holdings.

- It provides liquidity, ubiquity, and versatility when it comes to trading.

Generally speaking, adding silver to a retirement account is a great way to add long-term safety and security. Silver may also have more growth potential than other physical assets like gold because of its widespread usage in emerging technologies and finance, coupled with a relatively discounted price.

While it can be exhaustive researching the ins and outs of how to add silver to a retirement account, it’s well worth it.

Thanks to our top Silver IRA pick, Regal Assets, it is easier than ever to add silver to your retirement account. Regal is a one-stop-shop that can help you acquire silver, set up the necessary paperwork, safely store your assets and more. It eliminates the complexities of juggling multiple intermediaries just to add a little bit of physical silver to your nest egg. While other strong choices exist, with Regal, the entire process is streamlined.

Talk about the right place at the right time.

Summary Table 2: Top 5 Silver IRA Companies

| Gold IRA Company | #1 Regal Assets

'Regal Assets Logo from regalassets.com' |

|---|

‘JM Bullion Logo from jmbullion.com'

‘Kitco Logo from online.kitco.com'

‘Apmex Logo from apmex.com'

‘GoldSilver Logo from goldsilver.com'

‘Best for IRA rollovers 2021'

Awarded By Investopedia

‘Summary table by Jules Blundell'

NOTE: Precious metals aren't for everybody. They don't pay dividends and aren't as easy to liquidate as other "paper assets". They have been used traditionally as a hedge against market uncertainty and a way to preserve wealth for generations, but past performance can NEVER guarantee future returns. We recommend that you call a few Precious Metal IRA companies before making an investment decision. We also want to remind you that this content isn't financial advice and cannot be taken as such. Do your due diligence and speak to your financial advisor before making an investment decision.

About the Author

Robert Samuels is a financial copywriter and business consultant who has worked with various clients in numerous industries and sectors. He received his undergraduate degree from the University of Maryland and worked in music, sports, and entertainment for several years. Capped by a successful exit after selling a boxing website, Robert soon relocated overseas for a few years. After teaching himself stock market basics and financial fundamentals, he leveraged this newfound passion into a Master’s Degree from Harvard University’s ALM Finance extension program, where he received a 3.87 GPA and Dean’s List distinction.

Through this program, Robert also acquired a graduate certificate in Real Estate Investment and a graduate certificate in Corporate Finance. With a diverse professional background, both as an employee and entrepreneur, Robert is highly driven, passionate, and a great communicator who loves discussing finance.

![]()

from The Salt Lake Tribune https://ift.tt/1LdfbF6

Post a Comment